|

| Looks like the U.S. needs to go on a Debt Diet! |

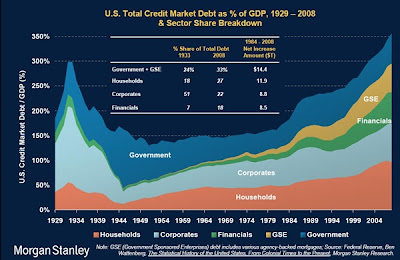

The PowerPoint slide above is from a Morgan Stanley presentation last year. It shows how the debt burden of our government, individuals, corporations and financial institutions has ballooned to unsustainable levels. You have to go back to the Great Depression to see data that is comparable to the debt burden we are collectively bearing today. To much debt is not just a problem in America--it is a global problem that impacts many developed countries today.

This weekend I read a very interesting study entitled “The Real Effects of Debt” that was published by the Bank for International Settlements (BIS) in September, 2011: http://www.bis.org/publ/othp16.pdf. The study indicates that many developed countries have too much debt and the result of this excessive debt will be less economic growth than we would have with lower debt levels. The BIS is often thought of as the central banker to central banks. It does not have much formal power, however its research is quite good and it is a very influential organization. In fact, it was one of the few international organizations that consistently warned the world about the dangers of excessive public and private debt prior to the collapse of Lehman Brothers.

This weekend I read a very interesting study entitled “The Real Effects of Debt” that was published by the Bank for International Settlements (BIS) in September, 2011: http://www.bis.org/publ/othp16.pdf. The study indicates that many developed countries have too much debt and the result of this excessive debt will be less economic growth than we would have with lower debt levels. The BIS is often thought of as the central banker to central banks. It does not have much formal power, however its research is quite good and it is a very influential organization. In fact, it was one of the few international organizations that consistently warned the world about the dangers of excessive public and private debt prior to the collapse of Lehman Brothers.

The BIS report looks at government, corporate and household

debt of 18 developed nations (the OECD nations) including the U.S. over that

last 30 years. The article notes that

debt can be good for a country, an individual and for corporations and that

debt if used correctly can increase economic growth. But at some point debt becomes a problem. Just like drinking wine and eating chocolate cake—at

some point what is pleasant in moderation becomes a problem in excess. A threshold is crossed and the amount of debt

suddenly becomes a drag on an economy and reduces a country's economic growth

rate.

The BIS report focuses on the amount of debt a country has

(household, corporate and government) as a percent of that country’s GDP in a

particular year. As you may recall,

Gross Domestic Product or GDP refers to the market value of all final goods and

services produced by a county in a given period, like a calendar quarter or

year.

What are the problematic debt levels that they identify in this study? The study estimates that a country's economic growth is reduced when debt levels cross the following thresholds:

What are the problematic debt levels that they identify in this study? The study estimates that a country's economic growth is reduced when debt levels cross the following thresholds:

- for government debt 85% of GDP

- for corporate debt 90% of GDP; and

- for household debt 85% of GDP.

So what are some of the results of this sobering study? Well, the authors of the study add up all

forms of the 18 countries non-financial debt (household, corporate and

government). They discover that over

the past 30 years the ratio of debt to GDP in these advanced economies has

increased on a relentless basis from 167% of GDP in 1980 to 314% in 2010. This means that over a 30 year period debt

increased by an average of 5% of GDP per year.

That is an amazing growth rate.

Luckily (but scarily) the U.S. has the fifth lowest total debt

to GDP ratio in the study. But don’t pat

yourself on the back yet—Greece had the fourth lowest total debt to GDP ratio—yes

that is right, Greece is doing better than the U.S. by this aggregate measurement. In the U.S. the aggregate of household,

corporate and government debt to GDP ratio went from 151% in 1980 to 268% in 2010 or a 4% of

GDP increase per year over the last 30 years.

Greece’s total debt to GDP ratio in 2010 was 262% (up from 92% in 1980) and Japan’s was 456% (up from 290% in 1980).

According to the study half of the countries had a

government debt to GDP ratio in 2010 that is equal to or less than the 85% of GDP threshold

and half of the countries are over that threshold. The countries over the government debt threshold

include: Japan (213%), Greece (132%), Italy (129%),

Belgium (115%), Canada (113%), Portugal (107%), France (97%), U.S. (97%) and

U.K. (89%). As you can see many

countries look like they need to go on a government debt diet. The three countries with the lowest

government debt to GDP ratio in the study are Australia (41%), Finland (57%)

and Sweden (58%).

The corporate debt threshold identified in the study is 90%

of GDP. Only three countries have

corporate debt to GDP ratios lower than 90%:

Greece (65%), U.S. (76%) and Australia (80%). The median corporate debt to GDP ratio in the

study for all 18 countries is 126%. The

three countries with the largest corporate debt to GDP ratios are Sweden

(196%), Spain (193%) and Belgium (185%).

According to this study many companies need to go on a debt diet.

The last threshold noted in the study is a household debt to

GDP ratio of 85%. Eight countries have a

household debt to GDP ratio of less than 85%.

The countries with household debt to GDP ratios in excess of 85% in 2010

are: Denmark (152%), Netherlands (130%),

Australia (113%), Portugal (106%), U.K. (106%), U.S. (95%), Canada (94%),

Norway (94%), Spain (91%) and Sweden (87%).

Again—it looks like a lot of households throughout the developed world

need to go on a debt diet.

So what can you conclude from this study? Many developed nations have too much debt and

until they complete a debt diet they will have

suboptimal economic growth. The best we

can hope for in the developed world is a muddling through economy until this

debt hangover runs its course.

The bright side for the United States is that on a relative

basis our household debt and government debt burdens could be worse, and sadly are in many other nations. But the negative of this report is that many

countries, including the U.S., have very difficult debt problems that they must solve and the likely solutions could negatively impact global economic growth rates for many years to come.

No comments:

Post a Comment